will child tax credit continue in 2022

The law authorizing last years monthly payments clearly states that no payments can be made after. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

2022 Child Tax Credit Letter 6419 Explained Youtube

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

. Under the new child tax credit provisions eligible. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early 2022. As it stands right now child tax credit payments wont be renewed this year.

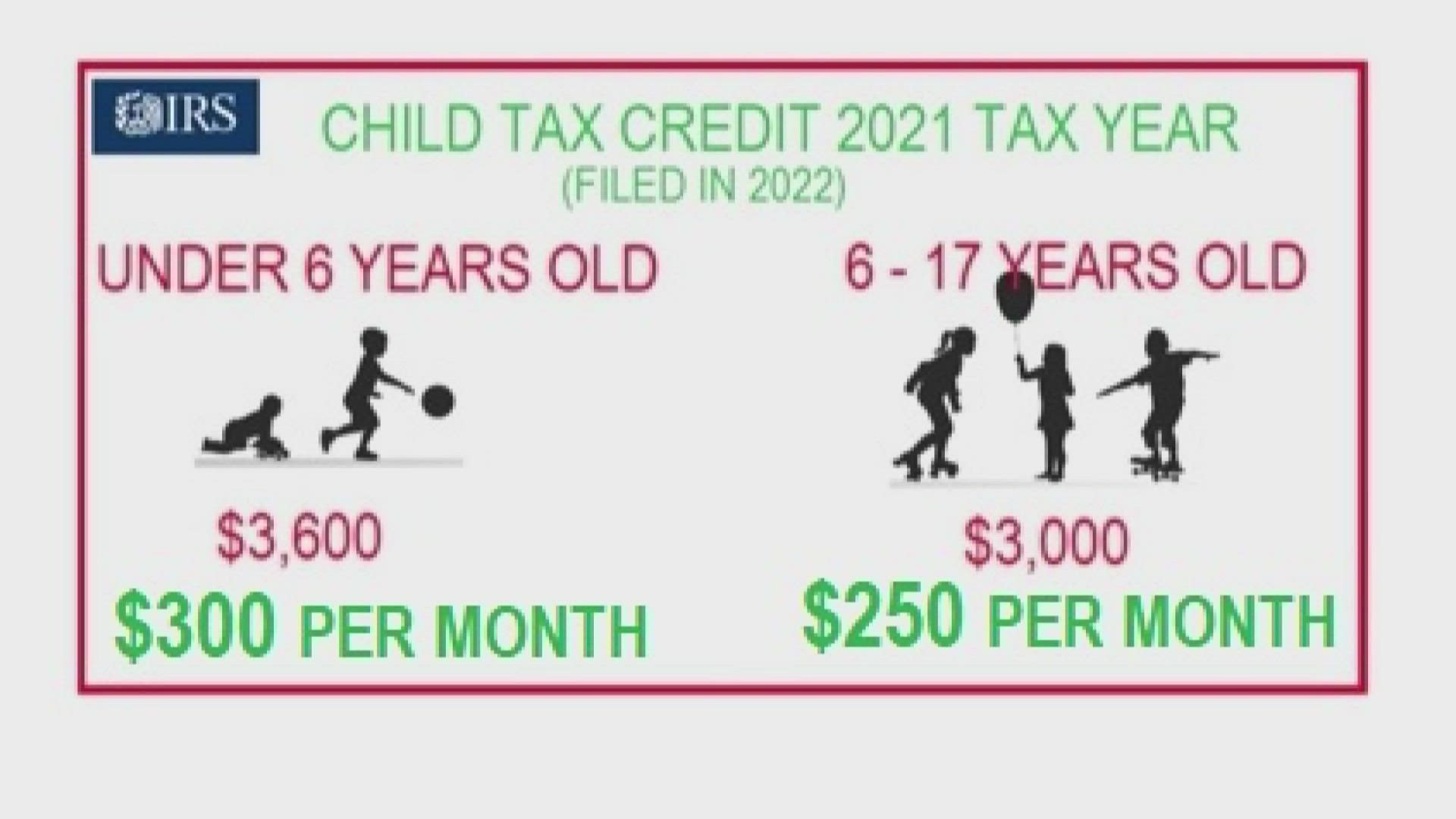

The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. This means that the credit will revert to the previous amounts of. As part of a COVID relief bill Democrats increased the tax credit to 3000 per child ages 6-17 and.

Prior to 2021 the Child Tax Credits maximum value was 2000 per child. Some families are missing out on the expanded child tax credit leaving up to 3600 per child unclaimed. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The 2021 increased child tax credit was part of Bidens 19 trillion American Rescue Plan that went into law in March 2021. The legislation known as the Tax Cuts and. 2 days agoBY BARRY LISAK.

The expanded child tax credit under the American Rescue Plan assisted many families financially. MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Last year that maximum value rose to 3600 for children under the age of 6 and 3000 for children aged.

1 day agoIts not just COVID-19 stimulus checks being left on the table. As taxpayers plan their 2022 taxes there is good news in the form of an enhanced child-tax credit. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. This credit begins to phase down to 2000 per child once household income reaches 75000. For your 2022 tax return the potential return per dependent aged 16 or younger scales back down to the original 2000.

The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. However parents might receive one more big payment in April 2022 as part of last years plan. The payments wont continue in 2022 for the new year.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. You see monthly payments. The maximum child tax credit amount will decrease in 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. In addition while last years tax credit was fully refundable the 2022. The IRS wants you to get your stimulus check and child tax credit cash if you havent claimed it heres what to look for Last Updated.

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. 15 2022 at 1214 pm. An expanded child tax credit would continue for another year.

Within those returns are families who qualified for child tax credits CTC. These payments were part of the American Rescue. October 6 2022 809 AM CBS Los Angeles.

After it lapsed in 2022 advocates called on Congress to continue providing.

Irs Wants Millions To Claim Child Tax Credit Stimulus Funds Wjtv

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Four Reasons The Expanded Child Tax Credit Should Be Permanent Rwjf

Will Monthly Child Tax Credit Payments Continue Into 2022 Whas11 Com

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Stimulus Update Final Child Tax Credit Payment Of The Year Arrives In 1 Week

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

48 Of Families Can T Afford Enough Food Without Child Tax Credit

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

The 2021 Child Tax Credit Implications For Health Health Affairs

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com